25

Dec

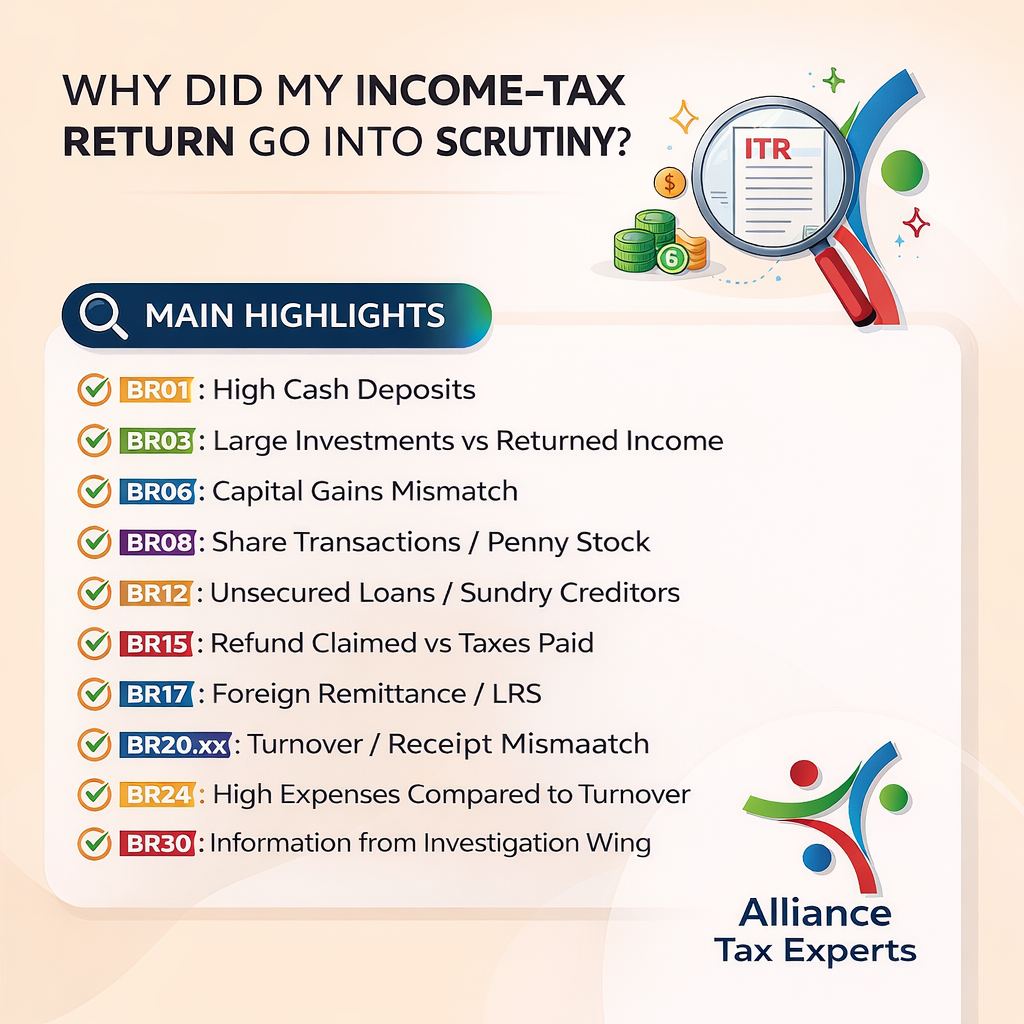

Why Did My Income-Tax Return Go into SCRUTINY?

Why Did My Income-Tax Return Go Into Scrutiny?A Practical Guide to Scrutiny Reason Codes (CASS / Faceless Assessment)Many taxpayers panic when they receive an Income-tax Scrutiny Notice. The first reaction is usually fear—“Have I done something wrong?”The reality is very different.Scrutiny is not an allegation. It is only a verification…

Read more

17

Sep

Important Things to Do After Filing Your ITR

Important Things to Do After Filing Your ITR (Income Tax Return)Filing your Income Tax Return (ITR) before the due date is a big achievement, but the process doesn’t end there. Many taxpayers think once the return is filed, the job is done. In reality, there are important steps to take…

Read more