25 Dec

Why Did My Income-Tax Return Go into SCRUTINY?

Why Did My Income-Tax Return Go Into Scrutiny?

A Practical Guide to Scrutiny Reason Codes (CASS /

Faceless Assessment)

Many taxpayers panic when they receive an Income-tax

Scrutiny Notice.

The first reaction is usually fear—“Have I done something wrong?”

The reality is very different.

Scrutiny is not an allegation.

It is only a verification process used by the Income-tax Department to

check certain transactions that appear unusual or inconsistent when compared

with data available to them.

Understanding why your return was selected is the

first and most important step to handling scrutiny successfully.

What Is Income-Tax Scrutiny?

Income-tax scrutiny is conducted under the CASS (Computer

Aided Scrutiny Selection) system and, in most cases, completed under the Faceless

Assessment Scheme.

Returns are selected based on risk parameters, data

analytics, and third-party information such as:

- AIS

/ 26AS

- Bank

transaction reports

- GST

data

- Property

registrations

- Share

market reporting

- Foreign

remittance data

Each scrutiny notice is usually backed by a Business Rule

(BR) Code, which indicates the specific reason for selection.

Although CBDT does not officially publish the full list of

BR codes, certain codes have consistently appeared over the years.

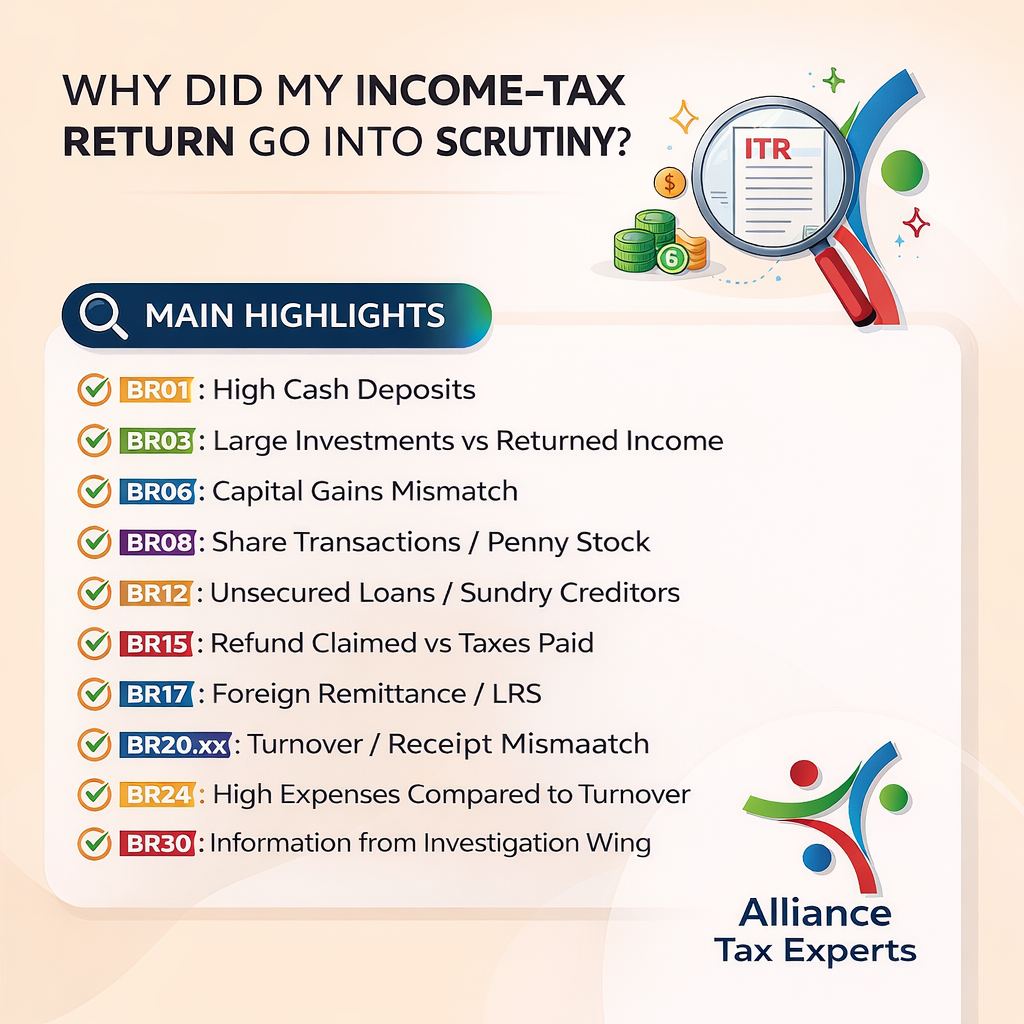

Common Scrutiny Reason Codes and What They Mean

BR01 – High Cash Deposits

This trigger applies when cash deposits in bank accounts

appear disproportionate to the income declared in the return.

Typical situations:

- Cash-intensive

businesses

- Frequent

deposits and withdrawals

- One-time

large cash deposits

Key requirement:

A clear cash flow statement explaining the source and movement of cash.

BR03 – Large Investments vs Returned Income

When a taxpayer purchases property, shares, or other

high-value assets, but the declared income does not seem sufficient to support

such investments.

Common examples:

- Property

purchase

- Heavy

stock market investments

- High

insurance premiums

Key requirement:

A proper source-of-funds explanation—loans, capital buildup, past

savings, or family funds.

BR06 – Capital Gains Mismatch

Mismatch between:

- Sale

consideration in ITR

- Stamp

duty value

- AIS

/ broker data

This is extremely common in property and share sale cases.

Key requirement:

Sale deed, computation working, and correct application of Sections 50C, 54,

54F, where applicable.

BR08 – Share Transactions / Penny Stock

Cases involving:

- High-risk

stocks

- Penny

stocks

- Unusual

trading patterns

These are flagged due to historical misuse of certain stocks

for accommodation entries.

Key requirement:

Complete demat statements, broker contract notes, holding period proof,

and transaction genuineness.

BR12 – Unsecured Loans / Sundry Creditors

Loans or creditors shown in the balance sheet that appear

suspicious due to lack of financial strength or documentation.

Key requirement:

Passing the ICG Test:

- Identity

- Creditworthiness

- Genuineness

PAN, ITR copies, and bank statements of the lender are

essential.

BR15 – Refund Claimed vs Taxes Paid

When a large refund is claimed or tax credits do not match

26AS/AIS data.

Common reasons:

- Incorrect

TDS credit

- Timing

differences

- Data

reporting delays

Key requirement:

Proper 26AS–AIS reconciliation with documentary proof.

BR17 – Foreign Remittance / LRS

Foreign transactions or remittances flagged under the Liberalised

Remittance Scheme (LRS).

Key requirement:

Purpose of remittance, source of funds, and FEMA compliance explanation.

BR20.xx – Turnover / Receipt Mismatch

One of the most common scrutiny reasons today.

Mismatch between:

- ITR

turnover

- AIS

/ 26AS

- GST

returns

- Bank

credits

Key requirement:

A 3-way reconciliation and identification of non-income receipts such as

reimbursements, loans, or internal transfers.

BR24 – High Expenses Compared to Turnover

When profit margins appear unusually low or expenses seem

excessive.

Key requirement:

Expense break-up, business justification, and past-year comparison to establish

commercial reality.

BR30 – Information from Investigation Wing

Cases selected based on third-party intelligence, surveys,

or search-related inputs.

Key requirement:

Demanding complete material relied upon and responding strictly based on

evidence and principles of natural justice.

How Faceless Scrutiny Is Decided

In faceless assessment, personal explanations carry no

weight.

Decisions are based entirely on:

- Reconciliation

- Supporting

documentation

- Legal

clarity and factual presentation

Poorly drafted replies or incomplete documents often lead to

unnecessary additions—even when the case is genuine.

Key Takeaways for Taxpayers

- Scrutiny

does not mean tax evasion

- Most

cases are resolved when facts are explained properly

- Early

and structured replies significantly reduce litigation risk

- Documentation

matters more than arguments

Professional Insight

In my experience, 90% of scrutiny additions fail

when:

- Transactions

are genuine

- Books

are maintained properly

- Replies

are legally structured and evidence-based

Faceless scrutiny is a technical process—not an emotional

one.

Need Help With a Scrutiny Notice?

If you’ve received a scrutiny notice and are unsure how to

respond, professional guidance at the right stage can save time, money, and

stress.

Santosh Patil

Founder – Alliance Tax Experts Pvt Ltd

Tax | Scrutiny | Faceless Assessment | Litigation Support

#IncomeTaxScrutiny #FacelessAssessment #CASS #AIS #DirectTax #TaxLitigation #IncomeTaxNotice #CharteredAccountant #AllianceTaxExperts