23

Feb

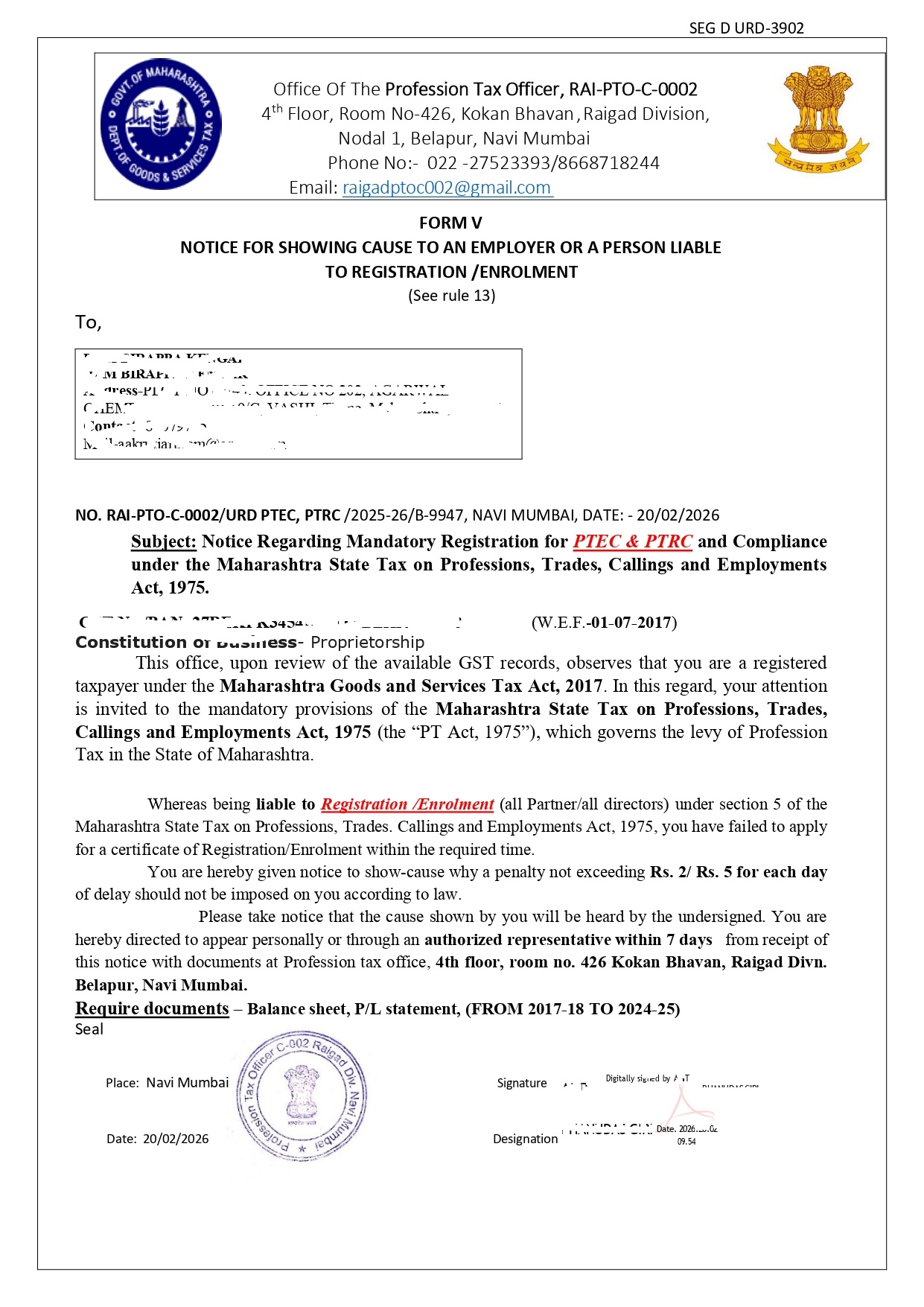

received a PTEC PTRC Notice

Received a PTEC/PTRC Notice? Don’t Panic — Understand It FirstMany business owners receive this Form V notice even when they are already registered in PTEC/PTRC, or when one of the two (PTEC or PTRC) is still not registered. So first thing — don’t worry. This notice is common, and I’ll…

Read more

05

Feb

Running a Business in Navi Mumbai These GST Mistakes Can Cost You Lakhs

Running a Business in Navi Mumbai?These GST Mistakes Can Cost You LakhsIf you are running a business in Navi Mumbai, GST compliance is not something you can afford to take lightly.Every month, business owners across Vashi, Turbhe, APMC, Sanpada, Nerul, and Kopar Khairane approach us only after receiving GST notices,…

Read more